Since 1992, students and their parents have anxiously awaited the month of October, the time when the Free Application for Federal Student Aid (FAFSA) becomes available to applicants. Last year, users were met with a notice that the FAFSA application for the 2024-2025 academic year would be delayed and available by Dec. 31, 2023, due to the FAFSA Simplification Act.

The FAFSA is an application that students and their parents can fill out to qualify for federal student aid in the forms of grants, loans and work-study programs. The process was simplified to address rising concerns about the efficiency and fairness of the FAFSA application.

The FAFSA Simplification Act was signed into law in 2020, citing “long-standing concerns” over the applications’ length and complexity, alongside a lack of transparency, and predictability of how the application is used. The law states that these factors may discourage access and attainment of postsecondary educational opportunities. The process was simplified to address rising concerns about the efficiency and fairness of the FAFSA application especially in a digitally literate age and for minority students.

“It was so time consuming, all that work and all the tax documents I had to collect.”Sabah Hagos, FCLC ’25

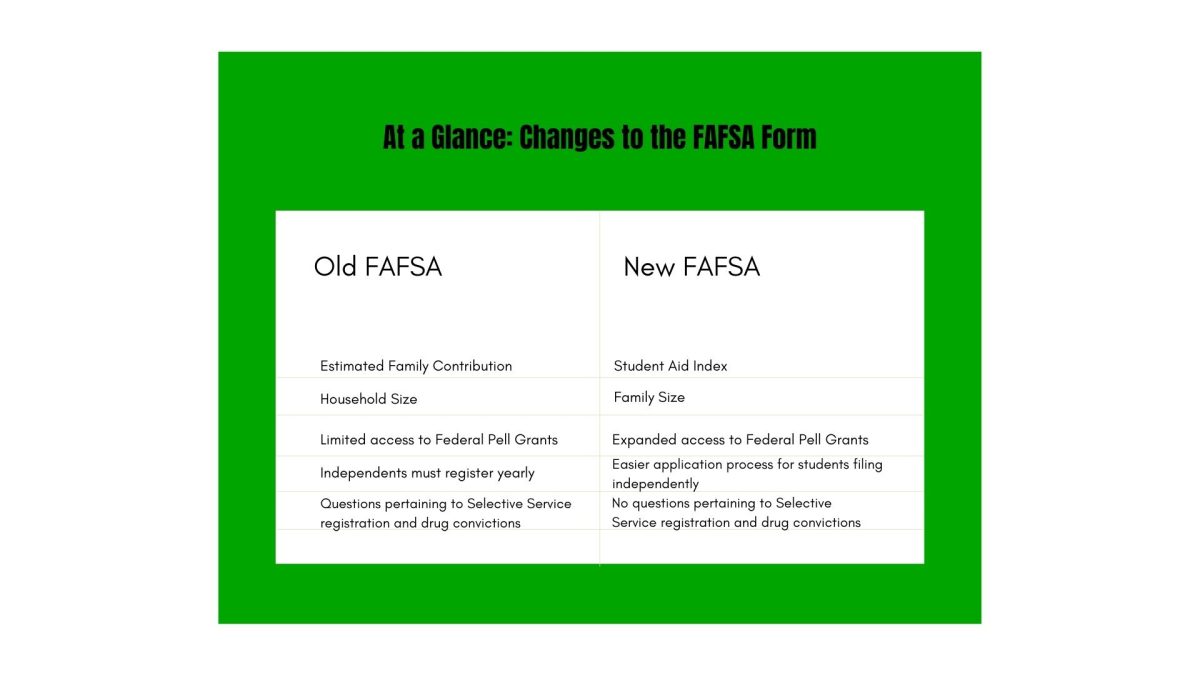

Some major adjustments to the form included replacing the Expected Family Contribution section — information from this section of the application was utilized by college financial aid offices to determine how much financial aid a student would receive if they were to attend their institution. The financial aid offices then referred to the Student Aid Index, which utilizes a need-based analysis. According to FAFSA’s website, the goal of the simplification is to expand access to Federal Pell Grants, and provide students with a more “streamlined” process.

The simplified form offers a few new benefits to some students from minority or disadvantaged backgrounds. With the new FAFSA format, a student can fill out the form without a parent or guardian’s financial information in certain circumstances such as when a parent is abusive, neglectful, absent or incarcerated. In this case, they will not have to confirm their independent status yearly. This change intends to make higher education more feasible for children whose parents classify into the above categories.

Sabah Hagos, Fordham College Lincoln Center (FCLC) ’25, said that she filed her FAFSA without parental guidance. She expressed that the previous format was very difficult to navigate.

“It was so time consuming, all that work and all the tax documents I had to collect,” Hagos said. “I have entered the form wrong multiple times.”

Urmila Das, FCLC ’25, echoed similar sentiments about students filling out the form incorrectly, and not receiving the correct amount of aid because of it.

“One question that asks about whether you are willing to give your parents information is worded weirdly. A lot of people made a mistake with that question, and had to get it fixed,” Das said.

Despite soft-launching on Dec. 30, 2023, the FAFSA data will not be available to colleges until March, which will impact the expected timeline for students to receive financial aid offers. Typically, incoming students receive their financial aid offers in the early spring and commit to a school by the end of the spring semester, but this year that process is delayed.

University President Tania Tetlow expressed that the delay in FAFSA applications has been “a real tragedy.”

The U.S. Department of Education issued an update on Feb. 20 saying that it is “making further improvements to the Student Aid Index calculation.”

“We’ve adjusted our processing timeline to accommodate these updates, which means we’ll start sending FAFSA information to schools in the first half of March,” the notice said. “Once your schools receive your FAFSA information, they will determine your eligibility for financial aid and create financial aid offers several weeks later.”

This delay in the applications has affected students currently enrolled at Fordham University, as well as many incoming students who typically make their commitment decisions based on financial aid offers.

“There has been a delay in releasing this year’s form, and many families have experienced difficulties in completing the FAFSA since its release,” Brian Ghanoo, associate vice president of the Office of Student Financial Services, said.

In a student press conference with The Fordham Observer and The Fordham Ram on Feb. 27, University President Tania Tetlow expressed that the delay in FAFSA applications has been “a real tragedy.” She added that the form was utilized to extend tentative packages of financial aid, subject to confirmation from the FAFSA, but that the delay did not halt the distribution of financial aid packages in acceptance letters since Fordham utilized its own supplemental financial aid form.

Ghanoo recommended that families begin completing the FAFSA as early as possible to accommodate potential delays and issues, and suggested that students monitor the Federal Student Aid web page for FAFSA updates.

“Current students can expect to receive their financial aid offers in mid-to-late June,” Ghanoo said. “Financial aid offers to newly admitted students are being delivered as scheduled based on their Admission Plan.”

The Office of Student Financial Services also created a FAFSA Simplification webpage as a resource for families as they navigate the new process.