Fordham Offers Tuition Insurance Plan Through Dewar Program

Dewar Tuition Insurance Plan allows students to be protected during the pandemic

July 16, 2020

The Office of Student Financial Services announced an option for students to enroll in additional insurance through the Dewar Tuition Refund Plan, which will provide additional support for students who may need to leave school due to medical reasons.

The email regarding the opportunity also explained that while due dates for tuition will appear, the university will not be imposing late fees due to the coronavirus pandemic.

Fordham has plans to return to campus in the fall, however, with the pandemic and the spread of the virus throughout New York, students may need to withdraw due to personal illness and concerns about returning to campus. The Dewar Refund Plan would allow students in those circumstances to receive part of their tuition back regardless of how far into the semester it is.

“I think it’s really nice that Fordham is giving students the option to apply insurance on their tuition, God forbid they cannot continue due to health reasons,” Stella Pandis, Fordham College at Lincoln Center ’21, said.

Under the Dewar Tuition Refund Plan, students can receive up to 75% of select fees back if they are affected by an illness recognized by the International Classification of Diseases or the American Psychiatric Association’s Diagnostic and Statistical Manual. Additionally, students would need to receive certification from a doctor confirming the condition in order to be eligible.

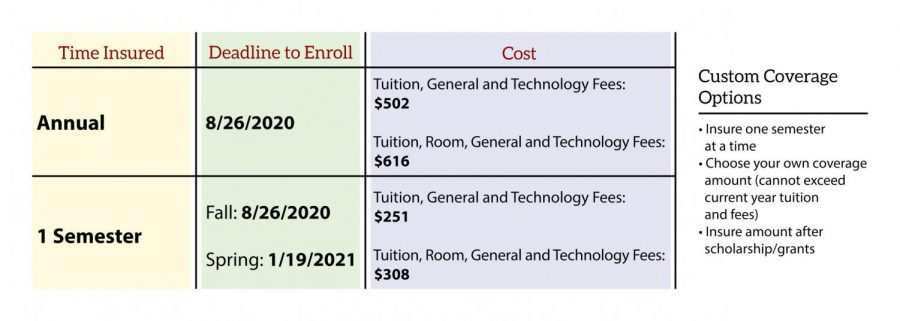

In order to utilize the Dewar Refund Plan, students need to pay a premium cost, which is “based on the amount of tuition, fees and room that is being covered,” President of A.W.G. Dewar Inc. Phil Beattie told The Observer.

In order to enroll in the Dewar Tuition Refund Plan, students must fill out the Dewar CRP Application. They can then choose to either Dewar’s general coverage or choose to insure a different amount of tuition.

The cost of the general-coverage Dewar plan per semester to cover typical Fordham tuition, general and technology fees is $251, according to Beattie. For residential students paying for room, it would cost $308 per semester.

Pandis expressed that she did not like that students would have to pay for the insurance since there is an ongoing pandemic.

“I understand the university faced financial hardship from the refunds in the spring but I genuinely believe if a student could not continue school during a pandemic the university should be more accommodating in regards to refunds,” Pandis said.

Fordham also has its own refund policy where students can receive 100% of their tuition back if they request a refund before the start of the semester. If students withdraw later in the semester, they are then able to receive a smaller portion of tuition refunded.

“Tuition Insurance complements the University’s tuition refund policies,” Director of Student Accounts Stefano Terzulli said. “For example, if a student withdraws early in the semester, that student may be eligible to receive most of their tuition back under Fordham’s refund policy. A student withdrawing later in the semester may not receive any tuition reimbursement at all. Tuition insurance helps close a portion of that gap for students who withdraw due to personal illness.”

According to Terzulli, Fordham has been partnering with Dewar for 14 years. However, many students were not aware that they had the option to purchase tuition insurance.

“I can guarantee that this insurance is not advertised at all. Incoming freshmen should get an email about this just like we do to explain the insurance fees. I wish I knew this was an option before my senior year,” Pandis said.

Terzulli said that Fordham chose Dewar specifically because it protects students who are forced to withdraw due to personal illness without any added conditions.

“We found their exclusion for claims is less stringent than other companies that provide this service,” Terzulli said. “For example, some companies that offer tuition insurance will only provide coverage for mental health withdrawals that require hospitalization. With Dewar, there is no hospitalization requirement for a mental health withdrawal claim.”

Jeffrey Ng, director of Counseling and Psychological Services, explained that it is important for hospitalization not to be a requirement because “hospitalization is not a diagnostic criterion for any formal psychiatric or psychological diagnoses.”

Terzulli stated that the Dewar insurance plan cannot be used to refund tuition if classes are once again shifted online due to the coronavirus pandemic, unless the student withdraws due to personal illness.

“Opting in for tuition insurance is a personal choice that every family needs to make. Given the pandemic, should a student take ill and be forced to withdraw, Dewar Tuition Insurance can help provide some financial relief,” Terzulli said.

Brian Adams • Jul 21, 2020 at 9:16 am

Director of Student Accounts Stefano Terzulli is wrong. I went to NYU and their policy is with GradGuard – there are not hospitalization requirements for mental health and they offer superior coverage and up to 100%.

Worse – why can one person make a decision that 75% is acceptable to Fordham students and families. If I went to NYU – I could purchase 100% coverage and it would include academic fees and deposits.

Fordham students deserve something better? Why don’t we at least have a choice to purchase 100% coverage? Who thinks losing 25% – or likely $10,000 is acceptable?