Going for Broke: Of Credit Cards and Cornbread Lines

June 20, 2011

Published: April 2, 2009

Today I tried to log on to my bank’s Web site, and, when at first the page didn’t come up, I found myself wondering for more than just a moment whether my bank had suddenly, in the last few hours, collapsed. I tell my friends of this impulse, and we all laugh nervously. These are strange times. Uncertain times. Scary times, especially for those of us who are graduating soon, hoping for find work amid mass layoffs and suddenly failing companies.

These are bad times, but at the moment, we are hypnotized, transfixed by the mushroom cloud. Our future prosperity is collapsing, and all we can do is watch—and bicker. Our fear and uncertainly lead to anger, but so far our position is inexplicable. We do not yet know who to blame. So we lash out jealously, if justly, at instances of excess amidst the chaos: AIG bailout bonuses and the Big Three’s corporate jets.

What we fear is the 1930s come again, Great Depression II, breadlines and shantytowns (the latter is already happening). We fear the pangs of real hunger once again visiting the bellies of the middle class. But the world is different this time around. We do not imagine that we can manufacture our way out, and any war massive enough to mobilize our recovery would surely be massive enough to destroy us as well.

At the rate we are going, the more likely scenario is more insidious. The middle class gets by, more or less, working crap jobs and racking up credit card debt, spending our stimulus checks on gas and groceries. We’ll get by, yes, but our prosperity will dully slip away, along with our dreams of a grand science-fictional future, and before we know it, our civilization will be overwhelmed by other crises of climate and energy and war—disasters we might have been able to stop, or prepare for, had we not stumbled at such a delicate time. This scenario isn’t inevitable, but it’s a real danger.

It is an oppressive feeling, seeing doom come on so slowly. It clouds the mind, like white noise. But through it all, I believe we are starting to get the feeling that there is something wrong here besides bad banks and bad loans and pernicious financial instruments. Could the problem be deeper? Could it be that our foundation was already crumbling, our roof already rotted and dry when the first proverbial molotov hit?

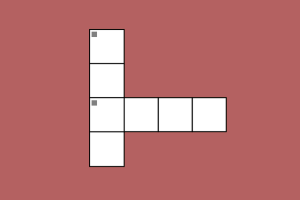

There is a graph making the rounds on blogs and radio shows that ask these questions. It charts household debt—car loans, student loans, credit card debt, mortgages—as a percentage of GDP. This is a graph that shows two peaks, two points that mark the only times in our nation’s history when this percentage reached 100 percent—when we have owed as much as we were producing. These peaks were 1929 and 2007.

We don’t have all the pieces yet, but graphs like this hint at a larger syndrome. Should we find a way to save the banking system? Sure. But I suspect this might not be enough. We don’t just need to heal our banking system; we need to reform our debt-happy lifestyle and the financial norms that support it. We must establish a new relationship between individuals and lenders—one that demands responsibility from both parties and that facilitates trust. After all, we want creditors to lend—just not too much. We want people to be able to borrow. Just not too much.

The Obama administration does not seem to grasp the scope of the crisis or the real problem. This is not surprising. When Obama first declared his presidential bid, he no doubt imagined that his major tasks would be dealing with failed wars, restoring the country’s tarnished image abroad and establishing, finally, a universal healthcare system. Fixing the most complex and esoteric failure of the most complex and esoteric part of our economic system was not what he had bargained for, and the plans of ambitious men are not easily changed, even by the tides of history.

Obama’s financial team seems to be laboring under the illusion that the economy will right itself as soon as the banks can process toxic assets into real capital—like passing a kidney stone. But this economy needs major surgery. The problem is long-term and systemic: not the hangover after Wall Street’s binge on bad mortgages, as former President Bush suggested to an accidentally live microphone, but the result of an addiction to credit and debt—an addiction we have to kick, no matter how bad the withdrawal might get.

Obama and Geithner have to steel themselves to the task of being America’s economic surgeons, and the country—all of us—need to be ready to go under the knife. Our economy will heal, eventually, and it may even come out stronger in the end. But it will take sacrifice and struggle on our part and vision and focus from our leaders. As scary as it might be, and as unprecedented, our best option might be going for broke. We have to. We’ve seen the alternative.