Don’t Rely on Loan Forgiveness: Save for College

Student Loans Should Be Addressed Before College Even Begins

November 16, 2011

Students who graduate often find themselves struggling to repay the loans they took on to pay for their education. According to a recent report by the Institute for College Access & Success, the average graduating student with loans owes more than $25,000—more than ever before. A big part of those loans is provided by the federal government at subsidized rates, for example through its Stafford loan program. In order to make college more affordable, the federal government now wants to cap annual repayments. No matter how much a student owes, he or she will never have to make payments exceeding 10 percent of his or her income. Moreover, any outstanding balance will be forgiven after 20 years, or after 10 years for those entering public service.

Congress passed this change already and scheduled it to go into effect in 2014. The Obama administration has now decided to move up that date, and it may take effect as early as next year. The argument behind the policy is that forgiving student loans is how the government should make college more affordable. The policy is severely misguided and unlikely to solve the actual problem. Instead, loan forgiveness merely provides an incentive for people to take on as much in loans as they can.

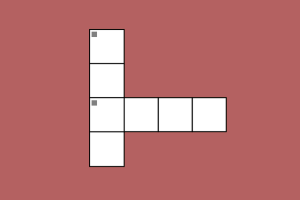

Whether one owes $60,000 or $160,000, the caps for Stafford loans for undergraduate and graduate students, respectively, will make little difference for the average student. A quick back-of-the-envelope calculation shows that the median income for college graduates ($50,000) would cap repayment at $5,000 per year, which over 10 or 20 years is $50,000 and $100,000 respectively. In many cases, this would not be enough to repay the principal, much less any accrued interest. Thus, there is a strong incentive to take on additional debt, knowing one will never have to repay the full amount anyway.

Aside from this, the policy also creates the impression that student loans are what families are expected to take on. If everyone has student loans, then forgiving parts of them could be seen as lowering the cost of education. However, for most households, saving for a college education is not out of the question. As long as they plan far ahead, the savings required to pay for even full tuition are reasonable.

A rough calculation shows that if parents put aside $400 per month for 18 years, they will have $160,000 saved. That is sufficient to cover tuition at Fordham and most other expensive private universities. Keep in mind that scholarships are widely available, as is on-campus employment, so most students may not need that much in savings to pay for their education. At public universities, which most students attend, the tuition cost of $20,000 requires setting aside as little as $50 per month for the same duration. Particularly the latter is hardly out of reach for the middle class and even most low-income households.

The government should work to make education more affordable, but instead of tackling it at the end of student loans, it should help families save the money to pay for their child’s education from the start.

The state could encourage saving for college the same way it encourages saving for retirement. Making contributions to certain retirement accounts allows employees to make deductions on their tax returns and pay less in taxes. These accounts allow savers plenty of freedom in choosing how to invest their money and have become widely popular, replacing the pension systems previously available to most workers. In fact, a similar scheme for saving for college (instead of retirement) already exists. However, unlike retirement plans, there are severe restrictions on how the money can be invested and what can be purchased with it. Computers, for example, could not be paid for using funds from the college savings account, until that was temporarily changed as part of the 2009 stimulus bill—the change is set to expire next year.

Designing a successful college savings plan shouldn’t be particularly difficult, given that most of the work has been done for retirement savings accounts already. The two aren’t that different: in both cases someone saves for expenses they know are coming up. Investment choices should be no more limited than in private retirement savings accounts (IRAs). Tax deductions should be available to all households, and employers should be free to match their employees’ contributions with no limit. In case a family saves up and the student gets a full scholarship (or does not attend college), they could be taxed on their contributions and gains but not penalized beyond that. That way, there would be no reason not to start saving for college as early as possible.

The tax code has successfully been employed to promote savings for retirement and medical expenditures, home ownership and other things the government has found useful to promote. Why would Congress and the Obama administration focus on student loans, rather than using well established practices to increase savings? It’s time we establish proper incentives for saving for educational expenses and not just worry about how to pick up the broken pieces once students are burdened with debt.