Can the Global Economy Recover from COVID-19?

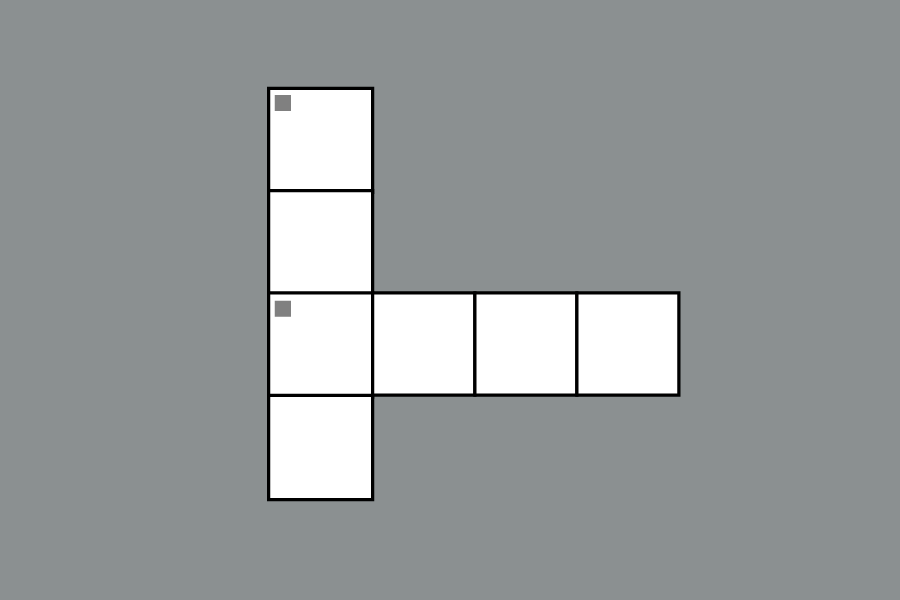

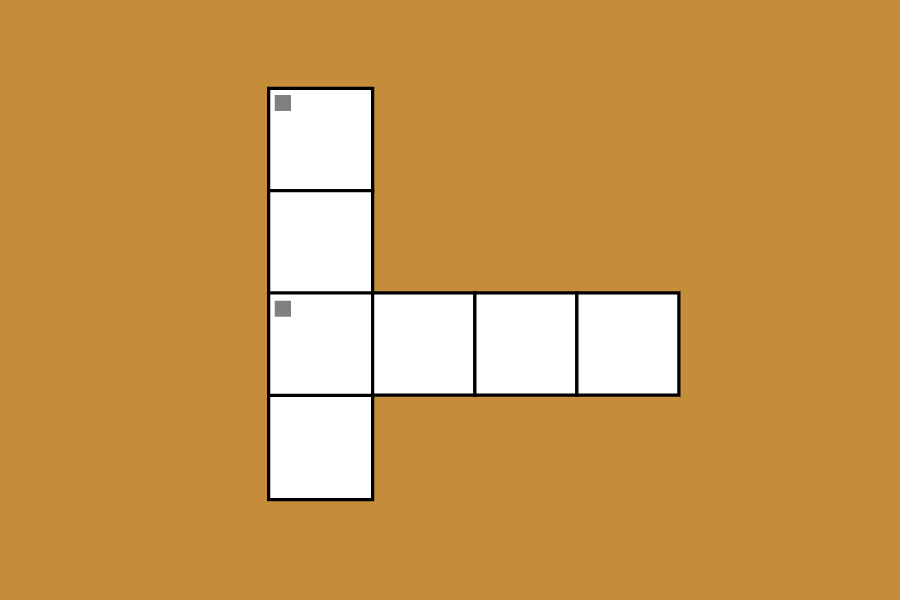

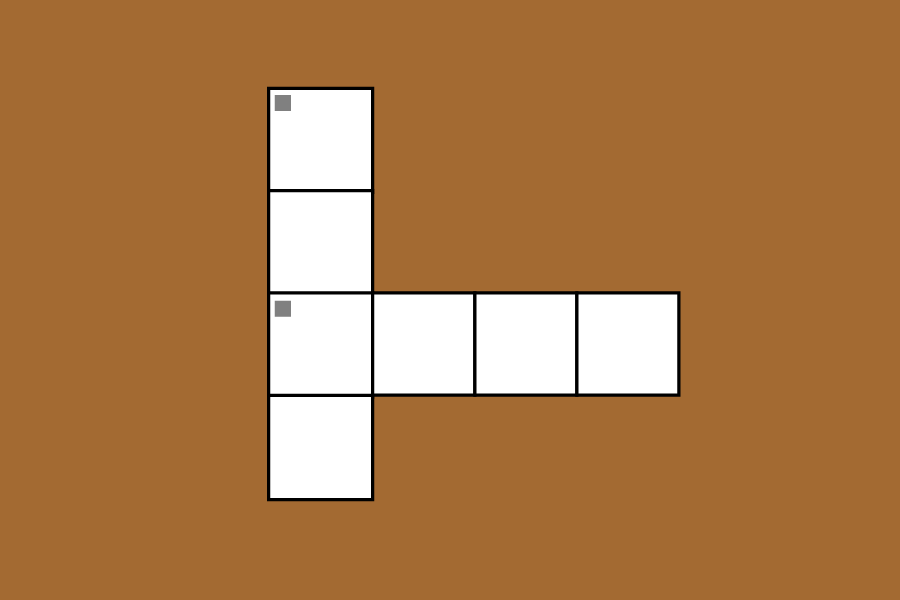

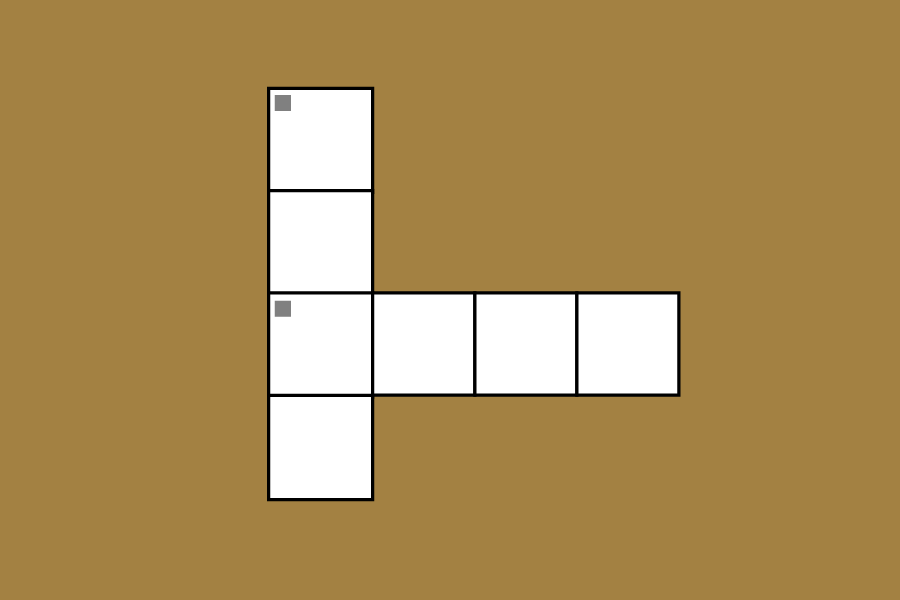

A chocolate production line remains motionless just days before Easter. The small business was forced to lay off half of its factory employees this past month. Small business employees like these must be the priority of government relief.

April 14, 2020

Within the last month, the entire world has been turned upside down by the global outbreak of the coronavirus disease 2019 (COVID-19), commonly known as the coronavirus. Extreme volatility has been felt in stock markets as many companies and industries are already fearing that 2020 could be a write-off in terms of business potential. However, if we play our cards right, the global economy could possibly recover from the coronavirus over the summer.

In order for this to happen, the worst of the pandemic in most of the world needs to be over by late April. A progressive and gradual return to normalcy will have to happen over much of the month of May. It will be a difficult balancing act supporting small businesses while protecting public safety, but governments around the world should focus on small business relief in their primary economic recovery packages to try to alleviate some of the unprecedented disruption from the coronavirus.

This relief should be focused, first and foremost, on employees. Many small business employees are currently furloughed or laid off. Any financial incentives to small businesses should be focused on urging these local businesses to rehire or retrain their employees so that they can continue working and maintaining a livelihood when business operations resume.

There will also have to be a carefully plotted mix of grants and loans in this relief to help small businesses resume a degree of normality. Financial institutions will likely be wary of solely giving grants rather than loans to small businesses, but low-interest loans could still be of tangible benefit to many businesses.

Over the course of the summer, businesses that expect to be able to rebound financially could gradually pay back those loans. This scenario is much more difficult, however, for businesses that will find it much harder to recover financially in the aftermath of the worst of the coronavirus pandemic, such as businesses related to the travel and tourism industry. It is unclear the extent to which the coronavirus will affect summer plans, but most people will still be wary of traveling internationally for a considerable amount of time.

There is also a sizeable economic boomerang regarding the revitalization of small businesses in the aftermath of the coronavirus: How much can non-discretionary consumer spending be expected to return to in the late spring and summer, both in the United States and in Europe? At least quasi-normal amounts of consumer spending are necessary for small businesses to thrive.

This is a difficult question, because there are many moving parts. First of all, when will Americans start feeling comfortable moving on to a more normal life? This could be as early as the end of April or as late as June. When they do, will they even be financially comfortable enough to modestly and occasionally patronize small businesses? These questions will serve as a tangent to the need for economic recovery over the summer in the aftermath of this devastating and unprecedented time.